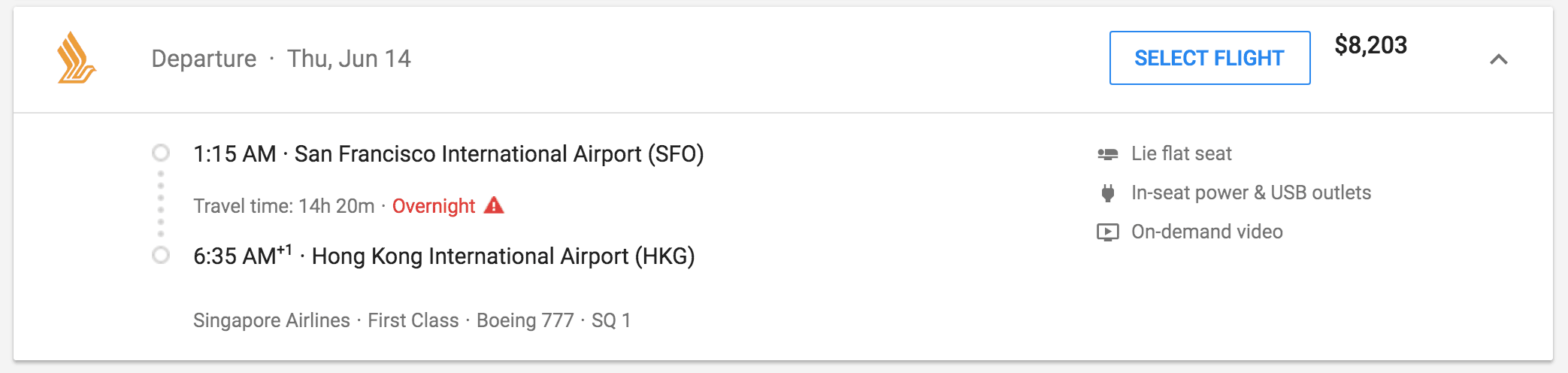

A couple years ago, I flew from San Francisco to Hong Kong in first class. I was a veteran when it came to enduring 20+ hour flights to Asia in narrow seats in economy. Never ever did I think I could cross the ocean in first class. This ticket cost over $8,000 and is something I couldn’t afford.

A couple years ago, I flew from San Francisco to Hong Kong in first class. I was a veteran when it came to enduring 20+ hour flights to Asia in narrow seats in economy. Never ever did I think I could cross the ocean in first class. This ticket cost over $8,000 and is something I couldn’t afford.

But I did fly first class to Asia and I didn’t pay $8,000. I only paid $268 and I’ll share exactly how I did it.

Before I reveal the travel hacking tactics I’ve used, I vlogged the whole trip which you can see here:

Spoiler alert: you will see me eat lots of delicious meals and spill wine.

Why am I even writing about this on Asian Efficiency? Isn’t this supposed to be a time management and productivity resource? After running AE for over 7 years now as one of the leading productivity companies, here are a few things I’ve learned:

- AE readers love saving time and making the most out of their life

- Lots of AE clients travel at least a few times a year

- I get asked all the time how I travel all over the world in first class and I never had a good resource to point them to

Now I do. I’ll show you in the most Asian Efficient way how you can fly first class for only a few hundred dollars. We could have easily created a course around this but as you know, at AE we like to give away some of our best content for free on the blog and podcast.

Travel Hacking 101

The first thing I want to get out of the way is that the strategies I’ve used are heavily geared towards people who live in the US. If you live outside the US, you can use the same ideas and strategies but you might need to tweak certain steps.

The reason I bring this up is that the way I got my first class ticket is by “gaming” the system. The American economy relies heavily on credit and people’s ability to borrow money and pay it off (ideally, on time without interest). The big banks make a lot of profit from people who borrow money and pay interest. Whenever you pay with credit card, you’re essentially borrowing money from a financial institution at zero percent interest for up to 30 days. When you fail to pay it off on time, you have to pay penalty fees and interest which are very lucrative for financial institutions. They make hundreds of millions of dollars this way.

That’s why they are eager to get people to use credit cards. They lend you funds for a month and expect you to pay it back. The banks count on the fact that a percentage of people can’t do that and that’s where they make their profit.

It’s in their best interest to get people to sign up and use their credit cards. That’s why almost all credit card companies offer a lucrative signup bonus. This could be $100 cash back or 50,000 points (sometimes 100,000 points). This is important to know because it’s essential to “game” the system.

A lot of credit card companies offer a large number of points as signup bonuses and they have their own points system. Usually, the way it works is that you get 1 point for every $1 you spend. So if you spend $100 on anything, you get 100 points. Those points can be redeemed as cash back (usually one point equates to one cent) but the more lucrative redemption is first class tickets.

Points and Transfers to Airlines

What a lot of people have figured out is that you can use those points to book business and first class flights. With most credit card companies, you can convert your earned points into airline points. For example, I might have 10,000 American Express points. I could convert those into 10,000 Singapore Airlines points (1:1 conversion rate) or 12,500 JetBlue points (1.25:1 conversation rate).

You might be wondering, what do all these numbers mean? Without some context, they’re just random numbers.

Most airlines have their own points system. The more you fly with one airline, the more points you get which you can redeem for free flights. For example, if I have earned 25,000 points on United from flying with them, I could redeem that for a free roundtrip in coach anywhere within the US.

But as I mentioned earlier, you can also transfer credit card points to airlines. If I had spent $25,000 dollars, I would likely have 25,000 points in my account. For most people, spending $25,000 on a credit card is pretty difficult to do.

That’s where the credit card signup bonuses are interesting for consumers like you and me. You can often get 50,000 or 100,000 points when you sign up for a credit card and meet their minimum spend (usually around $3,000 within first 3 months).

In other words, 50,000 points could be worth two roundtrips anywhere within the US. Instead of spending $50,000 (hard to do), you can sign up for a credit card and book you and your partner a roundtrip. Do you start to see how this can be an easy way to travel?

So how many points do you need for a first-class ticket? Here’s a scale of points you need to travel:

12,500 – one-way within the US (coach/economy)

25,000 – roundtrip within the US (coach/economy)

50,000 – roundtrip US-Europe (coach/economy)

60,000 – roundtrip US-Asia (coach/economy)

75,000 – one-way US to Europe and Asia (business class)

100,000 – one-way US to Europe and Asia (first class)

150,000 – roundtrip US to Europe and Asia (business class)

200,000 – roundtrip US to Europe and Asia (first class)

This is a simplified list. Every airline has its own numbers but this list gives you a good ballpark number for each type of fare.

For example, a one-way first class trip from the US to Hong Kong on Singapore Airlines (considered to have one of the most amazing first class experiences) would cost around $8,000 (yes, eight thousand dollars just to get there and not have a return trip). For most people, that’s out of reach.

But…you can book that same flight for around 125,000 points. This is a lot more attainable for people without needing to spend $125,000 on a card or even $8,000 in cash. By signing up for one or two credit cards, you have the ability to redeem a first class ticket to Asia.

All what I just described is what people call “travel hacking”. People sign up for credit cards to get signup bonuses to redeem them for flights they could never afford to pay for in cash. The credit card companies are fully aware of this and fine with it so you’re not doing anything illegal here. You’re just maximizing the use of your points in a smarter way (and saving a ton of money).

How I Did It

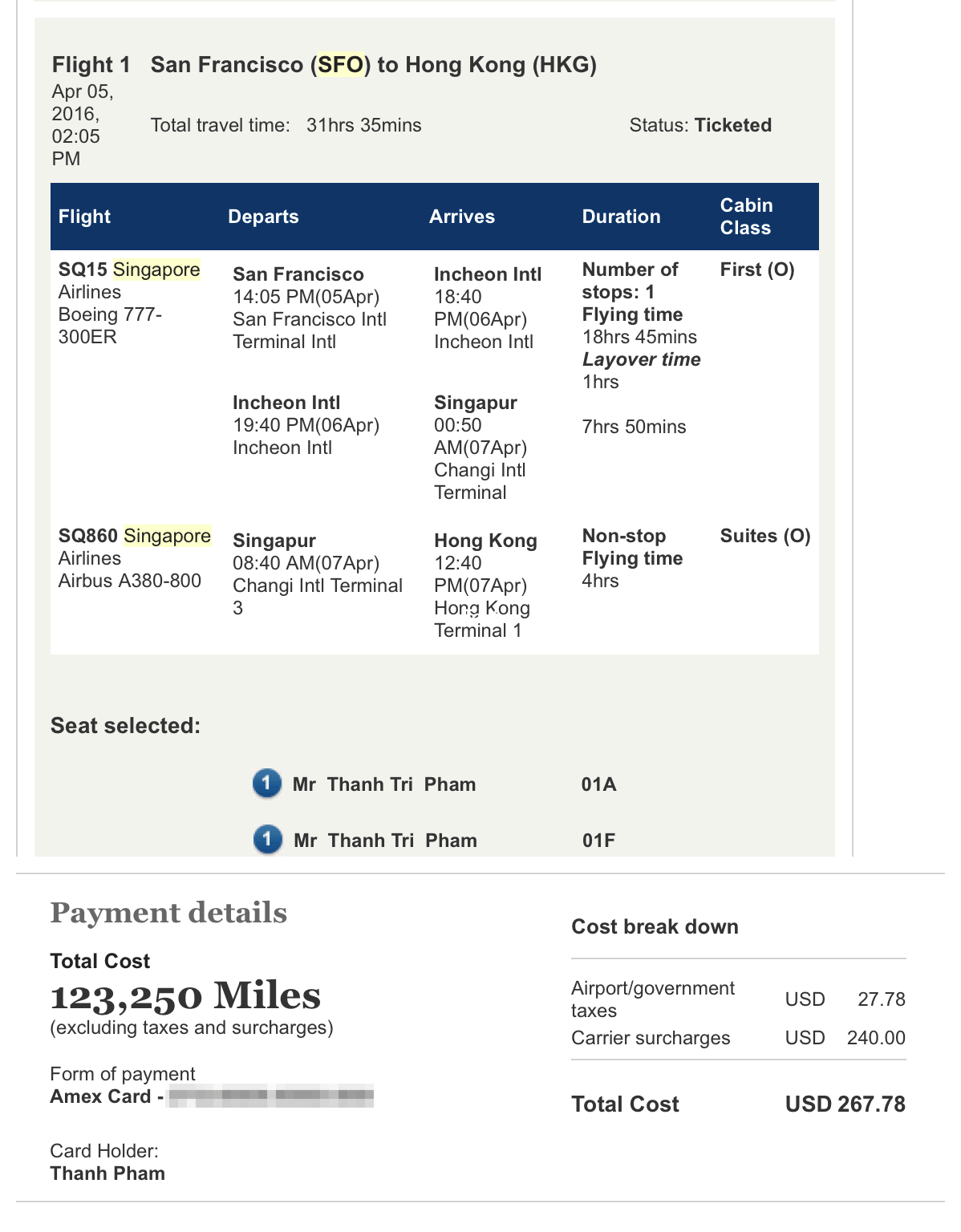

When I flew from San Francisco to Hong Kong (with a layover in Seoul and Singapore), I only spent $268 of my own money on the first class ticket. The rest was all paid by points.

Here’s the screenshot of the ticket to prove it:

As you can see, I spent $267.78 US dollars. When you look carefully, you also see that I paid 123,250 points. So how did I get those points?

By signing up for credit cards and redeeming the signup bonuses.

I signed up for the American Express Platinum and Premier Rewards Gold (PRG) card. Both offered 50,000 points as signup bonuses after meeting the minimum spend ($3,000 in first 3 months). What I usually recommend is that you don’t open multiple cards at the same time because the minimum spend can be difficult to meet. I got the AMEX PRG card first and then after I met the minimum spend, I opened the AMEX Platinum card.

Over a span of 6 months, I put all my expenses on these cards so I could meet the minimum spend. Whether it was dinners, Uber rides, groceries, or trips…everything went on my AMEX. I would literally ask every merchant if they accepted AMEX and if they didn’t, I would go elsewhere. Yes, I was THAT guy for a while.

But it was all worth it. I got my 100,000 points plus around 6,000 points from just meeting the minimum spend. So now I had 106,000 and I needed another 17,250 points for my trip. How did I get these?

I did it the old fashion way. I just kept using my card for all my expenses and about half a year later, I had all the points I needed for my trip. With around 125,000 points in my account, I transferred the AMEX points over to my Singapore Airlines account (which you make on singaporeair.com). After waiting about 48 hours, the points were in my account and I was able to redeem them for my flight to Hong Kong in first class. Normally this ticket would cost around $8,000 in cash but I paid only $268.

As I mentioned at the beginning, here’s the video again of what that trip looked like. It was a highlight for me to fly in first class for over 22 hours – something most of us would like to experience at some point in time. For only $268!

Spending Smarter

Now I know what you’re thinking. “Thanh, you also had to spend roughly $25,000 on your AMEX cards!” That is true over a span of a year. I wasn’t spending money just to spend it. Either way, I was going to spend that money on stuff I needed (groceries, accommodation, bills, etc). I was just being smarter about my spending and making sure it all went on my AMEX card instead of my debit card (which has no benefits at all).

You can accelerate it even more by using the right card for the right type of purchase. Most cards have different rewards for different kinds of purchases. For example, the AMEX Platinum gives you 5x for every $1 spent on travel. That means if you bought a plane ticket for $1,000, you would get 5,000 points. On the AMEX PRG, you get 2x for every dollar on groceries. Whenever I buy groceries, I make sure it gets charged on my AMEX PRG and not the Platinum (which is only 1x). In reality, I spent less than $25,000 to get the 25,000 points. I don’t know the exact amount but my guess is anywhere between $15,000 and $23,000.

My point is this: you are going to spend money either way on everyday stuff…might as well do it in the most Asian Efficient way for collecting points. I don’t want you to spend more than you need to. Just be smarter about how you spend it.

Saving Money

As you can see, you can actually save a lot of money on tickets when you shift your spending on certain credit cards. Someone like Mike (another productivity expert on the AE team), who has a wife and five kids, could save tens of thousands over his lifetime by employing some of the strategies I’ve outlined here.

In fact, if you have a business, you could open up business credit cards and earn points for all your expenses. That’s what we do at AE and as the owner, I’m fortunate to be the beneficiary of all the points which I frequently use for all my travels. Over the past few years, I’ve taken over 10+ trips in business and first class all over the world worth over $100,000 in value. As you now know, most of that wasn’t paid in cash but with points.

Next Actions

I truly believe everyone can experience a first-class trip overseas. When you sign up for a few credit cards and shift your spending to certain credit cards, it will be just a matter of time before you’ll be sipping champagne and eating steak on a plane.

So how do you get started? As with anything we release at Asian Efficiency, it’s going to be actionable and simple. Here’s what to do next:

- Read websites like The Points Guy and Frequent Miler to get an idea of how this “travel hacking” game works.

- Set a goal for yourself: how many points do you need to travel in first/business class to your destination? Use this as motivation to start learning about the travel hacking game.

- Start signing up for an American Express Platinum and Premier Rewards Gold card (not at the same time – leave at least 3 months in between).

- Shift your spending on your new card to meet the minimum spend and get your first signup bonus!

- Listen to this podcast episode we’ve done on travel hacking for more in-depth details and steps.

Inside the Dojo, our private productivity training library with a community, we have a course called “How to Organize, Pack and Travel Efficiently” that covers travel hacking and how to travel efficiently. It’s currently closed but sign up for the waitlist and we’ll notify you when we open up enrollment for it.

That's great, thanks for sharing your experience